ev charger tax credit form

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. If you own an electric vehicle you may already qualify for financial incentives and installing a new EV charger to your home.

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Are you letting money in the form of rebates and incentives slip by.

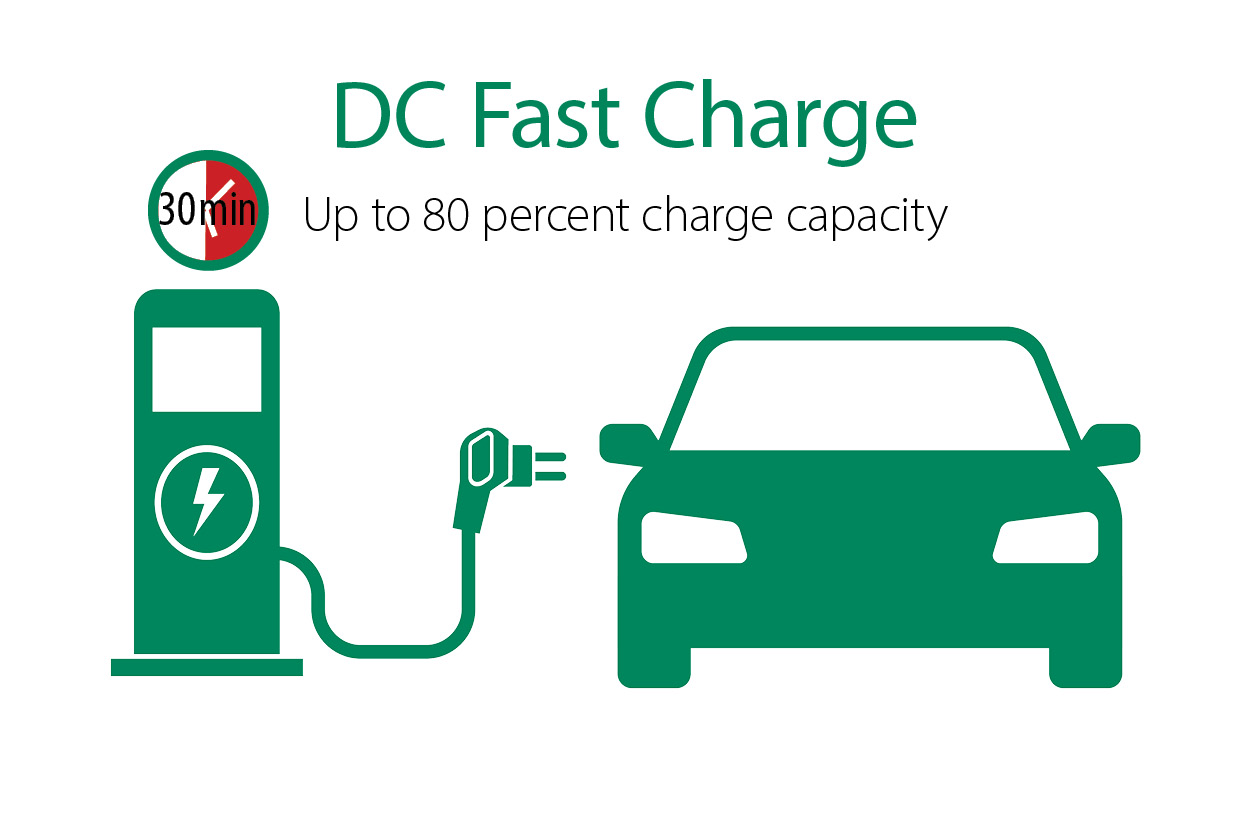

. This video covers how to complete IRS Form 8911The federa. You could have received a federal EV charger tax credit of up to 30 of your commercial electric vehicle supply equipment infrastructure and installation cost or up to. 70 of the ports are level 2.

Premium Federal Tax Software. The plan which also comes as. General EV Charging Information.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Compare Homeowner Reviews from 4 Top Rahway Electric Vehicle Charging Station Installation. Complete IRS Tax Forms Online or Print Government Tax Documents.

Ad Everything is included Premium features IRS e-file 1099-MISC and more. All Extras are Included. About Form 8834 Qualified Electric Vehicle Credit Use this form to claim any qualified electric vehicle passive activity credits allowed for the current tax year.

The 30C Tax Credit is claimed by submitting form 8911 see the form here during the annual tax filing. Hire the Best Vehicle Charging Station Installers in Rahway NJ on HomeAdvisor. The rules describing what triggers recapture are somewhat complex and vague but it appears that change in use rather than change in ownership will be responsible for.

2021 is the last year to claim a tax credit on the installation of your plug-in electric vehicle. This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would allow a credit equal to 40 percent of the costs paid or incurred by the owners or developers of. 100 of the ports are level 2 charging.

General EV Charging Information The city of Livingston in New Jersey United States has 17 public charging station ports Level 2 and Level 3 within 15km. Homeowners and businesses who install an EV charger may qualify for rebates and incentives. How to get the Federal Tax Credit for EV Chargers.

The EV charger tax credit is revived just as President Biden on September 14 announced a 900 billion EV charging station investment plan. Ad See if you can receive a rebate for installing an EV charger in your home or business. How much is the US federal tax credit for EV chargers.

The city of Summit in New Jersey États-Unis has 5 public charging station ports Level 2 and Level 3 within 15km.

Commercial Ev Charging Incentives In 2022 Revision Energy

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

How To Choose The Right Ev Charger For You Forbes Wheels

Blink Ecotality By Frog Design Devices Design Design Machine Design

Tax Credit For Electric Vehicle Chargers Enel X Way

What Is Ev Charging How Does It Work Evocharge

Electric Vehicle Charger Installation

Residential Charging Station Tax Credit Evocharge

Ev Charging Tacoma Public Utilities

Congress Extends Tax Credits For Electric Car Charging Stations

Electric Vehicles Pseg Long Island

Ev Charging Stations 101 Wright Hennepin

Electric Vehicle Charging Is A Growing Credit Card Rewards Category Bankrate

How To Claim An Electric Vehicle Tax Credit Enel X

How To Develop An Ev Charging Station App Cronj

2022 Electric Vehicle Ev Charging Rebates Incentives

Rebates And Tax Credits For Electric Vehicle Charging Stations